Bitcoin isn’t just a coin. It’s the spark that ignited a trillion-dollar asset class. A Layer 1 blockchain, a protest against the system, and—depending on who you ask—a digital fortress… or a digital trap.

Some say it’s digital gold.

Some say it’s programmable freedom.

Others whisper: psy-op.

At Crypto Dummy, we don’t deal in hype. We deal in receipts.

🧱 What Is Bitcoin, Really?

Bitcoin launched in 2009, in the ashes of the global financial crisis. Its pseudonymous creator, Satoshi Nakamoto, left behind open-source code, a whitepaper, and a message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

From the start, Bitcoin was rebellion baked into math.

- It’s a Layer 1 blockchain (a base network that processes and finalizes transactions independently).

- It uses Proof of Work (PoW) (miners compete to validate transactions and secure the network).

- It has a fixed supply: 21 million coins, ever.

No CEO. No pause button. No money printer.

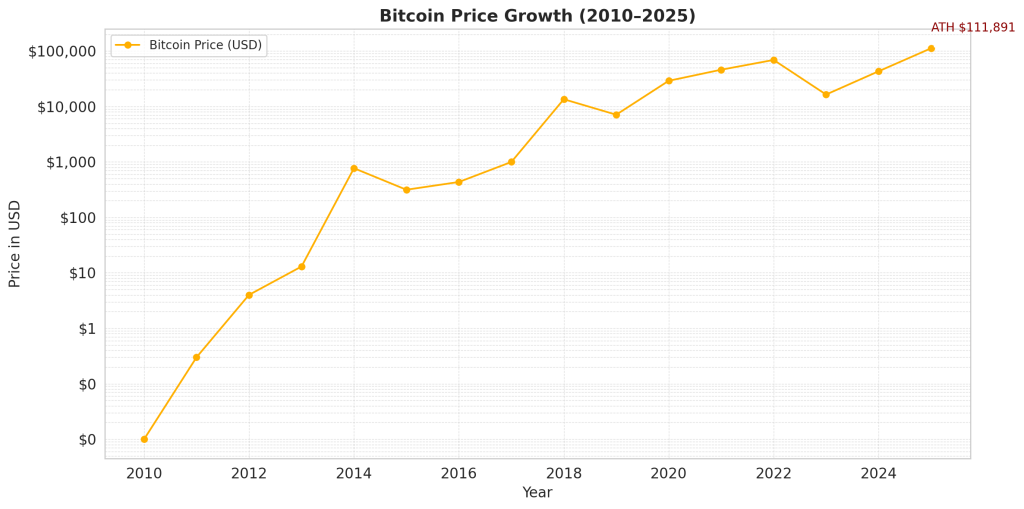

⏳ A Timeline of Disruption

| Year | Milestone |

|---|---|

| 2009 | Bitcoin network launches. First block mined. |

| 2010 | First real-world use: 10,000 BTC for two pizzas. |

| 2013 | Breaks $1,000 for the first time. |

| 2017 | Reaches ~$20,000. First wave of retail mania. |

| 2020 | Institutions start accumulating. MicroStrategy goes all in. |

| 2021 | All-Time High of $69,000. El Salvador makes BTC legal tender. Tesla buys in. |

| 2022 | Bear market hits. FTX collapses. BTC drops to ~$16K. |

| 2024 | Spot Bitcoin ETFs approved. Institutional demand surges. |

| 2025 | New All-Time High of $111,891.30 and $2.097T market cap. |

📊 By the Numbers (as of mid-2025)

- All-Time High: $111,891.30

- Market Cap: $2.097 trillion

- Total Supply: ~19.7 million BTC mined

- Max Supply: 21 million BTC

- Global Holders: 100M+

- Daily Transactions: 400,000+

- ETF AUM (2024–2025): $12B+ in assets under management

🏦 Bitcoin for Wall Street

In 2024, the SEC approved Spot Bitcoin ETFs, giving investors regulated exposure through traditional accounts. Top issuers include:

- BlackRock – iShares Bitcoin Trust ($IBIT)

- Fidelity – Wise Origin Bitcoin Fund ($FBTC)

- ARK/21Shares

- VanEck

- Grayscale (converted GBTC)

Bitcoin is now accessible through IRAs, pensions, hedge funds, and brokerage platforms. It’s not just for cypherpunks anymore—Wall Street is here.

💼 Bitcoin on the Balance Sheet

| Company | Holdings | Notes |

| MicroStrategy | 214,400+ BTC | Michael Saylor’s flagship strategy. |

| Tesla | ~10,725 BTC | Bought in 2021. Still holding. |

| Block Inc. | 8,027 BTC | Integrated BTC into Cash App. |

These companies treat Bitcoin as a treasury reserve asset, not a trade.

🌍 Sovereigns Are Watching

- El Salvador – First country to make BTC legal tender. Daily buys. Volcano-powered mining. Building “Bitcoin City.”

- Argentina – Adopting BTC to escape inflation.

- UAE, Nigeria, South Africa – Testing Bitcoin-friendly infrastructure.

- United States – In 2023, the Trump administration incorporated BTC into a Strategic Crypto Reserve framework.

Bitcoin is now treated by some nations like gold or oil: a sovereign-grade strategic asset.

🧠 Conspiracy Fuel (and Valid Questions)

Some ask:

- Was Bitcoin created by the CIA to test programmable money?

- Is Satoshi Nakamoto connected to NSA cryptography research?

- Did the 2008 crisis birth Bitcoin—or mask its true origin?

Crypto Dummy doesn’t deal in conspiracy—we deal in curiosity.

We say: ask better questions.

🚨 The Scarcity No One Talks About

There are 56 million millionaires in the world.

There will only ever be 21 million Bitcoin.

Even if every coin was distributed perfectly, most millionaires would go without.

That’s not fear. That’s math.

🔍 Bitcoin Quick Facts

| Feature | Value |

| Layer | Layer 1 |

| Consensus | Proof of Work (PoW) |

| Supply Cap | 21,000,000 BTC |

| Launch Year | 2009 |

| Security | Highest hash rate in crypto |

| Use Case | Store of Value, Settlement Layer |

| Key Holders | MicroStrategy, Tesla, El Salvador |

| Regulated Access | Spot ETFs approved (2024) |

📘 Crypto Dummy Glossary

- Layer 1 Blockchain — A base network that processes transactions directly (e.g., Bitcoin, Ethereum).

- Proof of Work (PoW) — A system where miners solve puzzles to secure the blockchain.

- Spot ETF — A regulated fund that holds real Bitcoin and trades on stock exchanges.

- Strategic Reserve — Government-held assets for national stability (e.g., oil, gold, now Bitcoin).

- HODL — Crypto slang for holding assets long-term.

- Satoshi Nakamoto — Bitcoin’s anonymous founder.

- Lightning Network — A Layer 2 upgrade for faster Bitcoin transactions.

🌟 Crypto Dummy’s Final Word

Bitcoin might be:

- The most important financial technology ever created…

- Or the most elegant digital trap ever deployed.

But here’s what we know:

Governments, corporations, and billionaires are buying it quietly.

Only a dummy would ignore that.

✉️ Join the Conversation

Do you believe Bitcoin is truly decentralized?

Do you trust it more than the dollar?

Tell us what you think at CryptoDummy.io or join the convo on X @CryptoDummy_x

Don’t ape. Don’t chase. Don’t trust the hype.

Do your own research.

Leave a comment