The shift from blockchain hype to blockchain plumbing is underway. Three major players—Institutional Blockchain Infrastructure Report: Ripple, JPMorgan, and Citigroup

The shift from blockchain hype to blockchain plumbing is underway. Ripple, JPMorgan, and Citigroup are embedding distributed ledger technology into the financial system. Their approaches differ, but together they show blockchain is no longer speculative—it is becoming the infrastructure behind global finance.

Ripple: Prime Brokerage Settlement Through Hidden Road

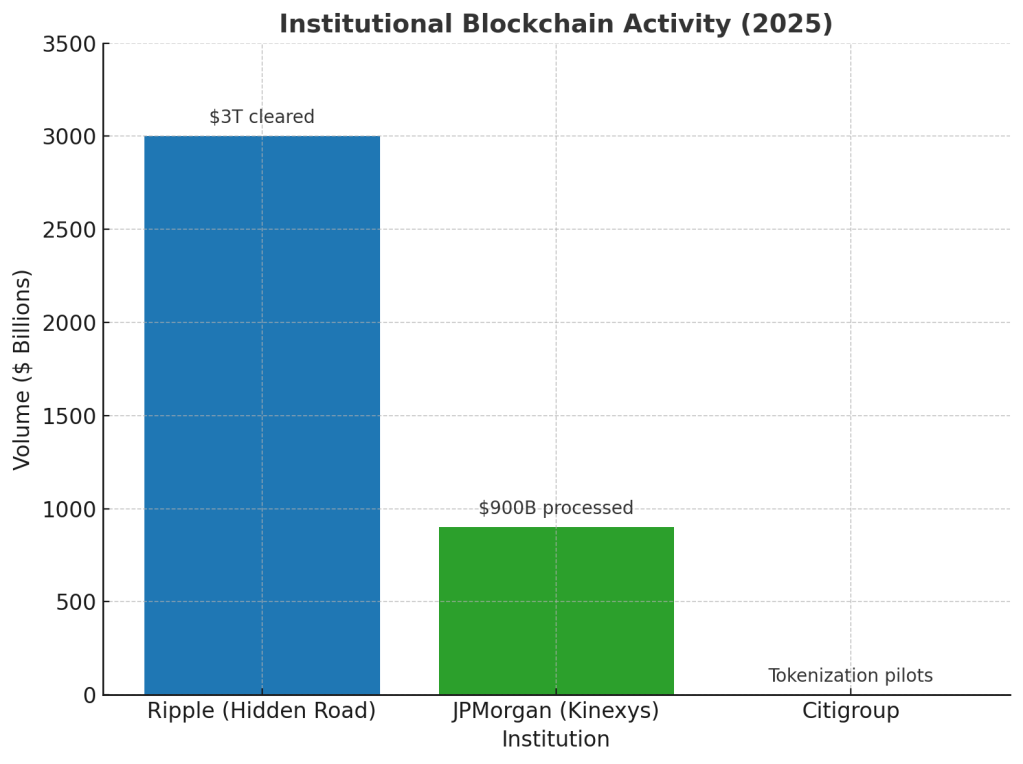

- In April 2025, Ripple acquired Hidden Road, a prime broker serving 300+ institutions and clearing $3 trillion annually, for $1.25–1.3 billion 【Reuters】【Barron’s】.

- Ripple will migrate Hidden Road’s post-trade operations to the XRP Ledger (XRPL), using RLUSD, Ripple’s stablecoin, as collateral for cross-margining 【Barron’s】.

- Hidden Road brings FINRA broker-dealer approval and FICC membership, providing Ripple direct access to U.S. clearing systems 【Finance Magnates】.

Example impact: Today, post-trade processes can take days. By moving to XRPL, Ripple is aiming for near-instant settlement—something that could eventually speed up retail brokerage activity as well.

JPMorgan: Real-Time Settlement With Kinexys

- JPMorgan rebranded its Onyx blockchain division as Kinexys in 2025, focused on settlement and tokenization 【JPMorgan】.

- JPM Coin is live on Broadridge’s DLR repo platform for delivery-versus-payment settlement 【ICMA】.

- Marex became the first clearing firm to adopt Kinexys for T+0 settlement in August 2025 【Ainvest】.

- By 2023, Onyx Digital Assets had processed nearly $900 billion in tokenized assets, including BlackRock projects 【MarketsMedia】.

Example impact: If your broker settles trades instantly instead of waiting two days, you face less counterparty risk. Institutions are already there; retail may follow.

Citigroup: Tokenization and Custody

- In 2025, Citi partnered with SIX Digital Exchange (SDX) to tokenize late-stage, pre-IPO shares 【Citigroup】.

- Citi piloted tokenized settlement with Wellington, WisdomTree, Fidelity, and T. Rowe Price 【Citigroup】.

- Citi launched Token Services for 24/7 on-chain treasury settlement 【Citigroup】.

- In August 2025, Citi said it is considering custody of stablecoin reserves, including U.S. Treasuries 【Reuters】.

Example impact: Tokenization could eventually let smaller investors access pre-IPO shares or money market funds in digital form, creating more flexible investment options.

Comparative Positioning

- Ripple: Brokerage and clearing. $3 trillion annual volume.

- JPMorgan: Real-time settlement. Nearly $1 trillion processed.

- Citigroup: Tokenization and custody. Partnerships with top asset managers.

Why It Matters for Investors

- Validation: Global banks are moving trillions through blockchain. This legitimizes the tech.

- Access: Tokenization could open markets that were once off-limits to retail.

- Stablecoin Security: If Citi holds reserves, stablecoins gain credibility as cash equivalents.

- Speed: Faster clearing means less risk. Retail markets could benefit over time.

- Portfolio Shift: Expect tokenized funds, bonds, and equities to merge with traditional offerings.

Sources

Reuters – Ripple to buy Hidden Road for $1.25B

Barron’s – Ripple’s $1.3B Hidden Road deal

Finance Magnates – Hidden Road secures FINRA approval

ICMA – JPM Coin delivery-versus-payment settlement

Ainvest – Marex adopts JPMorgan Kinexys settlement

MarketsMedia – Onyx processed $900B in tokenized assets

Citigroup & SDX – Tokenization of private markets

Citigroup Digital Assets – Token Services overview

Reuters – Citi explores stablecoin custody

Final Note: These institutional moves are shaping how money flows. They matter less for today’s trading hype and more for the financial rails of tomorrow. Always DYOR (Do Your Own Research) before making investment decisions.

Follow Crypto Dummy for verified updates on blockchain adoption in global finance. Stay informed so you can position your portfolio for the future.

Leave a comment